|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Understanding Cat Pet Insurance Prices: An In-Depth GuideWhen it comes to ensuring the health and well-being of our feline companions, cat pet insurance is often a topic of interest, albeit one that comes with a myriad of questions and concerns. Delving into the intricacies of insurance for your beloved pet can be daunting, but with a careful exploration of the factors influencing prices, one can make informed decisions that safeguard not only the health of their cat but also their financial peace of mind. Let's embark on a journey to demystify the costs associated with insuring your furry friend, while also considering whether such an investment aligns with your personal circumstances and values. Firstly, it's crucial to understand that cat insurance prices are not set in stone; they vary widely depending on several key factors. These include the age of your cat, its breed, the level of coverage you desire, and even your geographical location. Younger cats generally incur lower insurance costs due to their lower risk of health issues, whereas older cats might see a spike in premiums. Similarly, certain breeds predisposed to hereditary conditions could attract higher premiums, an important consideration for prospective cat owners to bear in mind. Furthermore, the type of coverage significantly impacts the cost. While basic insurance plans cover accidents and illnesses, more comprehensive plans might include wellness visits, dental care, and even alternative therapies. It is worth pondering whether the additional coverage aligns with your cat’s needs and your budget. Some owners find peace of mind in extensive plans, while others opt for more economical choices, trusting their ability to cover minor veterinary expenses out-of-pocket. Geography plays a surprisingly pivotal role in determining cat insurance prices. In urban areas, where veterinary costs tend to be higher, insurance premiums might reflect this increase. Conversely, rural areas might offer more affordable options. This geographic variance underscores the importance of comparing plans and providers within your specific locale. In evaluating the necessity of pet insurance, one must weigh potential costs against the likelihood of needing substantial veterinary care. For instance, indoor cats might have a lower risk of accidents, potentially reducing the immediate need for insurance. However, unforeseen circumstances such as chronic illnesses can arise, making a case for the financial protection insurance provides. Ultimately, the decision to purchase pet insurance hinges on personal circumstances and risk tolerance. Conducting thorough research and perhaps consulting with a trusted veterinarian can offer valuable insights. For those inclined towards insurance, leveraging comparison tools and reading customer reviews can illuminate the most suitable options. As we traverse this landscape of pet insurance, it becomes clear that while there is no one-size-fits-all answer, informed decisions are rooted in understanding the factors at play and aligning them with one's personal priorities. Frequently Asked Questions about Cat Pet InsuranceWhat factors influence the cost of cat pet insurance?The cost of cat pet insurance is influenced by factors such as the age of the cat, its breed, the level of coverage selected, and your geographical location. Younger cats and those from breeds with fewer hereditary health issues generally have lower premiums. Is it worth getting comprehensive coverage for my cat?Comprehensive coverage can be beneficial if you seek peace of mind for a wide range of health issues, including preventive care. However, it is essential to assess whether the additional costs align with your financial situation and your cat's specific needs. How does my location affect cat insurance prices?Location affects insurance prices due to variations in veterinary costs. Urban areas typically have higher costs, resulting in increased premiums, while rural areas may offer more affordable insurance options. Should I consider insurance for an indoor cat?While indoor cats may have lower accident risks, they can still develop health issues that require costly treatment. Insurance can provide financial protection in such cases, but it is important to evaluate the specific risks and benefits for your situation. What steps can I take to find the best insurance plan?To find the best insurance plan, compare different providers, review coverage options, use comparison tools, and read customer reviews. Consulting with a veterinarian can also offer guidance tailored to your cat's health needs. https://www.lemonade.com/pet/explained/pet-insurance-cost/

At Lemonade, a policy for a dog or a cat starts at $10/month. (Plus our affordable pet health insurance has won the approval of authorities like Money.com). https://www.fetchpet.com/pet-insurance-cost

With Fetch, the average cost of dog insurance is $35 per month and the average cost of cat insurance is $20 per month. But those are just averages, so tell us ... https://www.usnews.com/insurance/pet-insurance

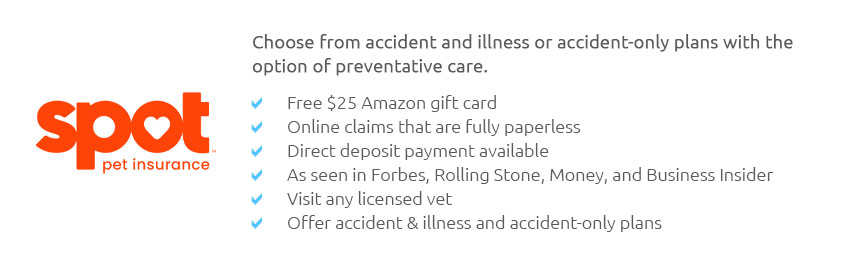

Coverage and Costs: Spot's sample rates are $49.33 per month for a dog and $23.86 per month for a cat. Its accident-and-illness plan includes coverage for exam ...

|